Welcome to this week’s publication of the Market’s Compass Crypto Sweet Sixteen Study #126. The Study tracks the technical condition of sixteen of the larger market cap cryptocurrencies. Every week the Studies will highlight the technical changes of the 16 cryptocurrencies that I track as well as highlights on noteworthy moves in individual Cryptocurrencies and Indexes.

This Week’s and 8 Week Trailing Technical Rankings of the Sixteen Individual Cryptocurrencies*

The Excel spreadsheet below indicates the weekly change in the objective Technical Ranking (“TR”) of each individual Cryptocurrency. The technical ranking system is a quantitative approach that utilizes multiple technical considerations that include but are not limited to trend, momentum, measurements of accumulation/distribution and relative strength. The TR of each individual Cryptocurrency can range from 0 to 50. The primary take-away from this spread sheet should be the trend of the individual TRs, either the continued improvement or deterioration, as well as a change in direction. Secondarily, a very low ranking can signal an oversold condition and very high number can be viewed as overbought. Thirdly, the weekly TRs are a valuable relative strength/weakness indicator vs. each other, in addition when the Sweet Sixteen Total Technical Ranking (“SSTTR”), that has a range of 0 to 800 is near the bottom of its range and an individual cryptocurrency has a TR that remains elevated it speaks to relative strength and if the SSTTR is near the top of its recent range and an individual cryptocurrency has a TR that remains mired at low levels it speaks to relative weakness. Lastly, I view the objective Technical Rankings as a starting point in my analysis and not the entire “end game”.

*Rankings are calculated up to the week ending Friday February 23rd

The SSTTR fell -9.30% to 561 last week from 618.5 for the week ending February 16th which was a 13.80% gain in SSTTR from the week before that. For the fifth week in a row Tron’s (TRX) TR was 49 or 50.

Only one of the Sweet Sixteen Cryptocurrencies registered gains in their individual TRs, three were unchanged and twelve fell. The one Sweet Sixteen TR that gained was TRX which only gained by one handle but nonetheless it rose to a perfect Technical Ranking of 50. The average TR loss was -3.49, which was a reversal of the previous week’s average TR gain of +4.69. Ten of the Sweet Sixteen ended the week in the “green zone” (TRs between 35 and 50), five were in the “blue zone” (TRs between 15.5 and 34.5) and one was in the “red zone” (TRs between 0 and 15). The previous week ending February 16th, there were eleven crypto currency TRs in the “green zone”, there were five in the “blue zone”.

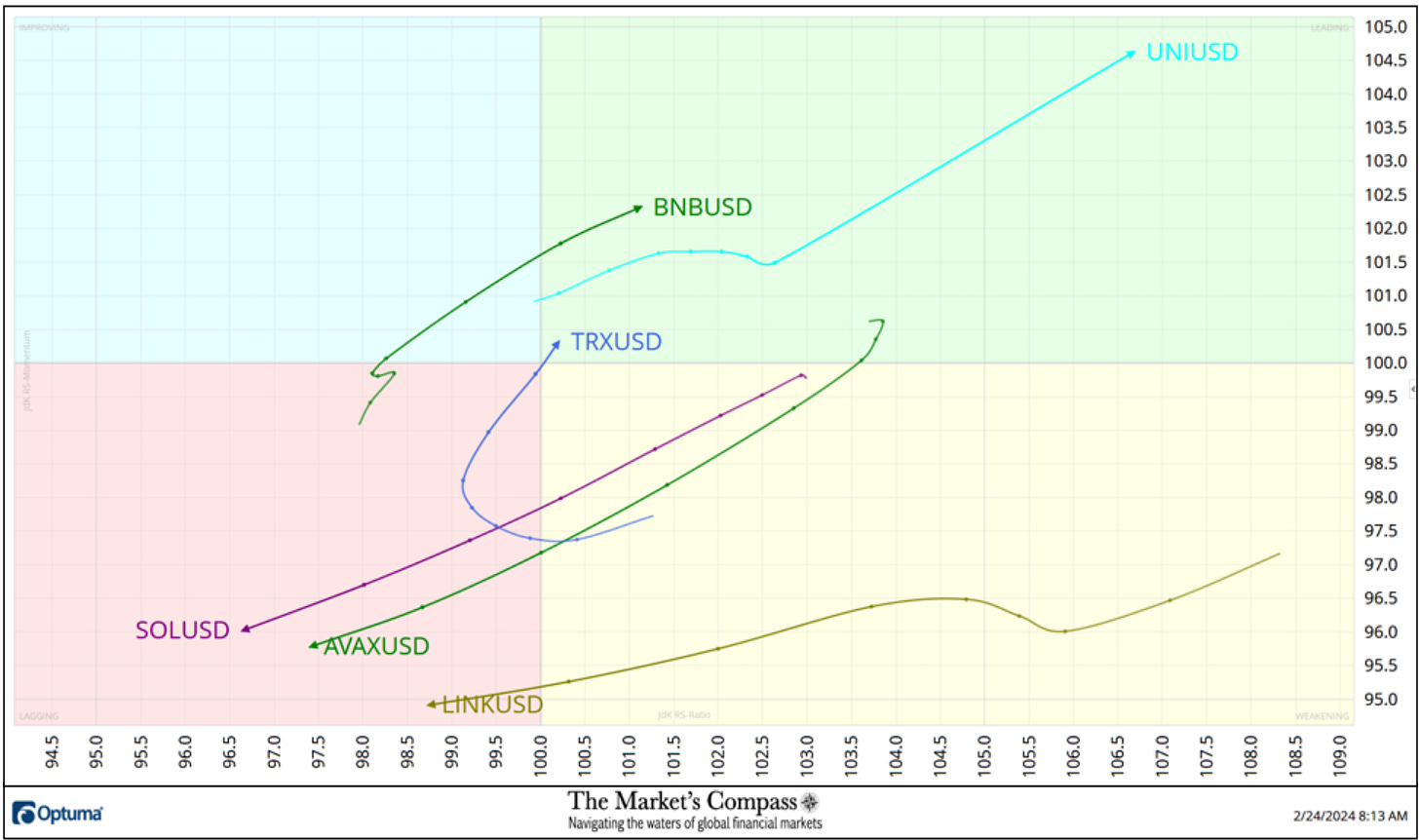

Relative Strength and Weakness in the Sweet Sixteen vs. The CCi30 Index* utilizing a Relative Rotation Graph

*The CCi30 Index is a registered trademark and was created and is maintained by an independent team of mathematicians, quants and fund managers lead by Igor Rivin. It is is a rules-based index designed to objectively measure the overall growth, daily and long-term movement of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding stable coins (more details can be found at CCi30.com).

The Relative Rotation Graph, commonly referred to as RRGs were developed in 2004-2005 by Julius de Kempenaer. These charts are a unique visualization tool for relative strength analysis. Chartists can use RRGs to analyze the relative strength trends of several securities against a common benchmark, (in this case the CCi30 Index) and against each other over any given time period (in the case below, daily since the end of the previous week). The power of RRG is its ability to plot relative performance on one graph and show true rotation. All RRGs charts use four quadrants to define the four phases of a relative trend. The Optuma RRG charts uses, From Leading (in green) to Weakening (in yellow) to Lagging (in pink) to Improving (in blue) and back to Leading (in green). True rotations can be seen as securities move from one quadrant to the other over time. This is only a brief explanation of how to interpret RRG charts. To learn more, see the post scripts and links at the end of this Blog.

Not all sixteen cryptocurrencies are plotted in this RRG Chart. I have done this for clarity purposes. Those of technical interest remain.

The standout relative strength performer late last week versus the CCi30 Index over the past seven trading days was Uniswap (UNI). Although it was already in the Leading Quadrant it took off higher on Friday (more on that later in the Blog). Binance (BNB) rose during the second half of the week gaining relative strength momentum by rising from the Lagging Quadrant through the Improving Quadrant and into the Leading Quadrant. Solana (SOL), Avalanche (AVX) and ChainLink (LINK) all are tracking lower in the Lagging Quadrant leaving the Weakening Quadrant behind. Tron (TRX) has done a complete turn from the Weakening Quadrant into the Lagging Quadrant and entering the Leading Quadrant on Friday.

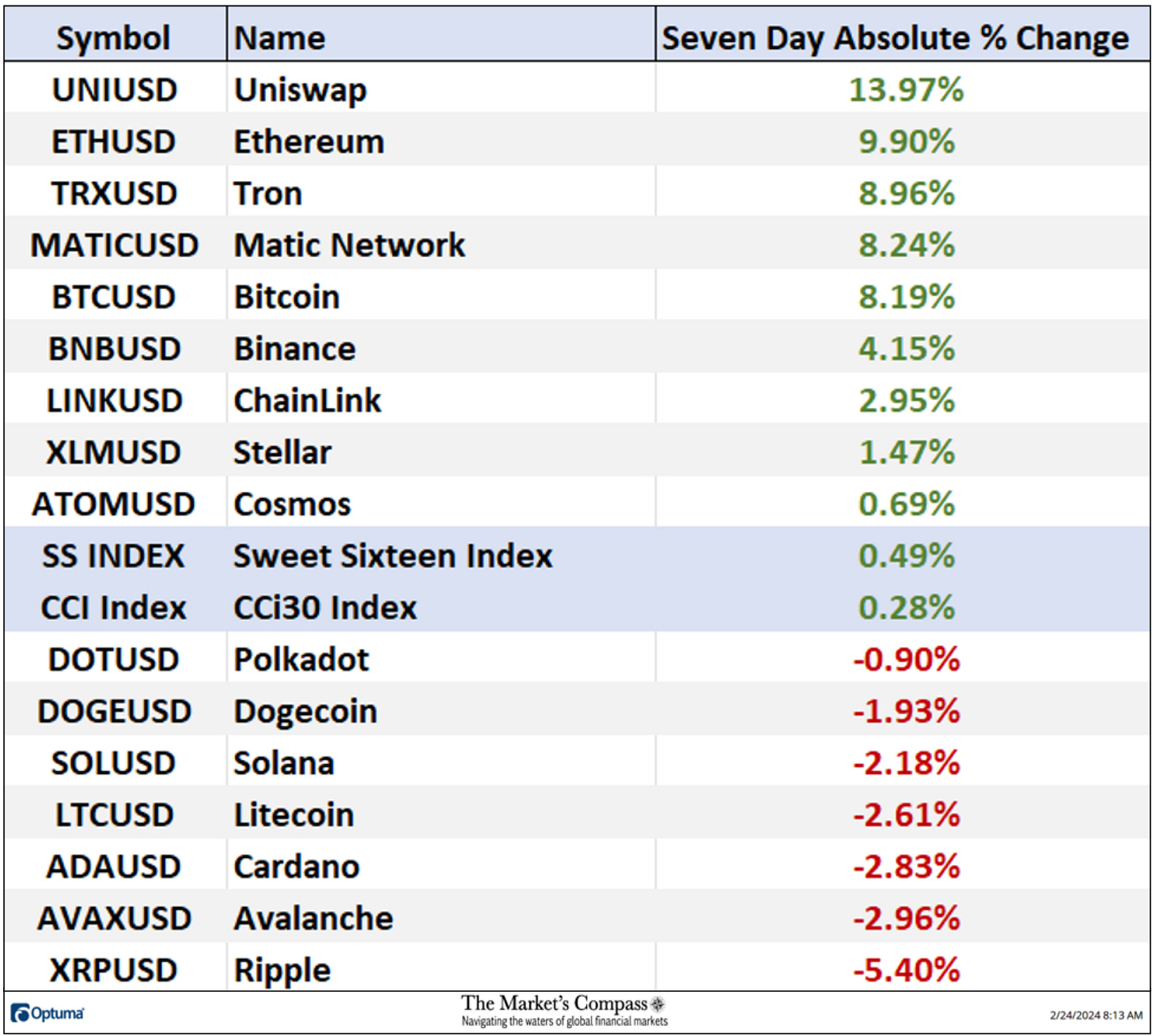

Seven Day Absolute % Price Change*

*Friday February 16th to Friday February 23rd.

Nine of the Sweet Sixteen registered absolute gains last week and seven lost ground. The seven-day average absolute gain was +2.25% adding to the week before +7.31% average absolute gain. The average absolute gain of the Sweet Sixteen Crypto Currencies on the week would have been +1.56% if not for the 13.97% gain in Uniswap (UNI). The previous week fifteen were up on an absolute basis and one lost only -0.03%, that was Litecoin (LTC).

The Technical Condition Factor changes for the week ending February 2nd with the trailing eight weeks added.

There are eight Technical Condition Factors (“TCFs”) that determine individual TR scores (0-50). Each of these 8, ask objective technical questions (see the spreadsheet posted below). If a technical question is positive an additional point is added to the individual TR. Conversely if the technical question is negative, it receives a “0”. A few TCFs carry more weight than the others, such as the Weekly Trend Factor and the Weekly Momentum Factor in compiling each individual TR of each of the 16 Cryptocurrencies. Because of that, the excel sheet below calculates each factor’s weekly reading as a percent of the possible total. For example, there are 7 considerations (or questions) in the Daily Momentum Technical Condition Factor (“DMTCF”) of the 16 Cryptocurrencies ETFs (or 7 X 16) for a possible range of 0-112 if all 16 had fulfilled the DMTCF criteria the reading would be 112 or 100%. A DMTCF reading at 85% and above suggests a short-term overbought condition is developing and a reading of 15% and below suggests a short-term oversold condition.

At the end of last week, the DMTCF fell to 65.18% or 73 from a a nearing overbought reading of 87.50% or 98 out of 112 points the previous week.

As a confirmation tool, if all eight TCFs improve on a week over week basis, more of the 16 Cryptocurrencies are improving internally on a technical basis, confirming a broader market move higher (think of an advance/decline calculation). Conversely, if more of the TCFs fall on a week over week basis, more of the “Cryptos” are deteriorating on a technical basis confirming the broader market move lower. Last week only one TCF rose and seven fell.

The CCi30 Index with this week’s Sweet Sixteen Total Technical Ranking (“SSTTR”)

The Sweet Sixteen Total Technical Ranking (“SSTTR”) Indicator is a total of all 16 Cryptocurrency rankings and can be looked at as a confirmation/divergence indicator as well as an overbought / oversold indicator. As a confirmation/divergence tool: If the broader market as measured by the CCi30 Index continues to rally without a commensurate move or higher move in the SSTTR the continued rally in the CCi30 Index becomes increasingly in jeopardy. Conversely, if the CCi30 Index continues to print lower lows and there is little change or a building improvement in the SSTTR a positive divergence is registered. This is, in a fashion, is like a traditional A/D Line. As an overbought/oversold indicator: The closer the SSTTR gets to the 800 level (all 16 Cryptocurrencies having a TR of 50) “things can’t get much better technically” and a growing number individual Crypto’s have become “stretched” there is more of a chance of a pullback in the CCi30. On the flip side the closer to an extreme low “things can’t get much worse technically” and a growing number of Crypto’s are “washed out technically” and an oversold rally or measurable low is closer to being in place. The 13-week exponential moving average in Red smooths the volatile SSTTR readings and analytically is a better indicator of trend.

The Upper Parallel (solid violet line) of the Standard Pitchfork (violet P1 through P3) has continued to cap the extension of the rally in the CCi30 Index but MACD reflects the continuation of upside price momentum. The Sweet Sixteen Total Technical Ranking (“SSTTR”) has pulled back from near overbought territory.

The CCi30 Index Weekly Cloud Model with the Average Sweet Sixteen Technical Ranking (ASSTR)*

*The Average Sweet Sixteen Technical Ranking is the average of the individual TRs of the sixteen cryptocurrencies we track at the end of each week.

The Average Sweet Sixteen Technical Ranking fell back to 35.06 from 38.66 but has remained above its 9-week Exponential Moving Average (red line) and the 45-week Exponential Moving Average (blue line). My only concern is that CCi30 Index remains stretched as can be seen by the distance between last week’s closing price and the Kijun Plot (green line) which is the midpoint of the highest high and lowest low over the past 26 weeks.

The CCi30 Index Daily Candlestick Chart

The CCi30 Index first encountered resistance at the Upper Parallel (solid gold line) of the Schiff Modified Pitchfork (gold P1 through P3) a week ago last Thursday. On a daily closing basis, it has continued to impede a continuation of the rally from the February 7th low. MACD has started to roll over and the Fisher Transform is not signaling an emanate turn in the Index. The Sweet Sixteen Daily Momentum / Breadth Oscillator (lower panel) has worked off most of the overbought condition and is tracking lower and is approaching oversold territory that has led to rallies in the past but first I need to see the 9-day simple moving average (red line) to turn up above the 45-day exponential moving average (blue line) to declare that the sideways price correction has run its course.

Relative Comparison to the CCi30 Index since January 1st*

*Includes Saturday February 24th

Charts are courtesy of Optuma whose charting software enables anyone to visualize any data including my Objective Technical Rankings. Cryptocurrency price data is courtesy of Kraken.

The following links are an introduction and an in depth tutorial on RRG Charts…

https://www.optuma.com/videos/introduction-to-rrg/

https://www.optuma.com/videos/optuma-webinar-2-rrgs/

To receive a 30-day trial of Optuma charting software go to…