In 2018 myself and my good friend and colleague Kyle Crystal of Lakeshore Technical Analysis wrote a series of White Papers on the history, construction and use in technical analysis of Andrews Pitchfork that was published in the Society of Technical Analysts in their quarterly publication. Over the next several weeks I will be publishing those in the Markets Compass Substack Blog.

It is the authors’ intent in writing this initial blog post is to draw a timeline that serves to describe the evolution of Median Line Analysis and briefly touch on those who have contributed to the development of what we know today as Andrews Pitchfork. In further blogposts I will dig deeper into construction and analysis of Andrews Pitchfork. The history of Andrews Pitchfork may leave impatient traders bored and chomping at the bit for the Construction and Analysis sections but researching and understanding the development over hundreds of years left the authors with a deeper understanding of why this time and price tool is invaluable.

Although the technical methodology known as Median Line Analysis as we know it today is rightly attributed to Dr. Alan Andrews, it should be known that it found its genesis hundreds of years before his time. That said, it was he who brought it forward to the study of stocks, bonds, currencies and commodities and his extensive analysis and studies are the basis of what is now referred to as Andrews Pitchfork. It has been elaborated on since his passing by several of his students who studied directly with him and by a number of learned and talented technicians who have, refined, and studied it in concert with other indicators. It has been said his disciples who were grain traders were responsible for attaching the moniker Andrews Pitchfork to the technique. It is my intention in this “Part One” to tell a brief history of the development of what we believe is an underutilized technical tool that belongs in every analyst’s toolbox.

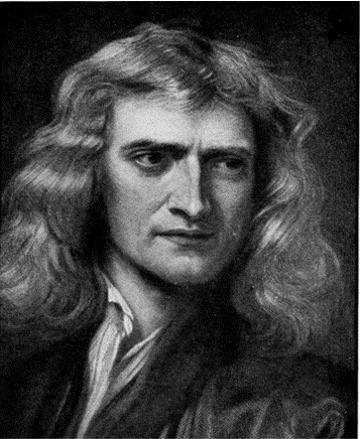

In the Beginning / Sir Issac Newton (1643-1726)

No that’s not a picture of Roger Daltry. Sir Issac Newton was unquestionably one of the most brilliant scientists to have ever lived. He was born prematurely on Christmas Day 1642 (Julian Calendar) in Woolsthorpe near the village of Colsterworth, seven miles south of Grantham in Lincolnshire County, England. He was named after his father who had died 3 months before he was born and was so tiny no one expected him to live. His mother remarried and cast him aside when he was three to be raised by his grandfather. When his stepfather died, he returned to his mother’s side when he was 10 years of age with her stepson and two step daughters moving back to his family’s home in Woolsthorpe.

When he was twelve his mother sent him away again but this time it was to attend King’s School in Grantham. He boarded in the home of an apothecary in a small attic room. It was during this period that he developed into what Richard Westfall in his book on Newton referred to as “A Sober, Silent, Thinking Lad”. He developed an interest in science and passion for chemistry living above that apothecary shop.

After a rough start at King’s School he began to excel academically which led to Newton finding himself at Trinity College in Cambridge in 1661. It was his time at Cambridge that he developed a long list of scientific understanding. What follows are two of the many discoveries that were a part of the genesis of what became Median Line Analysis.

The Emerald Tablet

Most of those who were responsible for the Scientific Revolution studied Hermeticism. These three wisdoms of the whole universe, alchemy, astrology, and theurgy played a vital role in the advancement of physics, astronomy, mathematics and natural sciences. There are three major Hermetic texts or doctrines (there are 47 scared texts in total that are known of) that have been attributed to Hermes Trismegistus, a syncretic combination of the Greek god Hermes and the Egyptian god Thoth. Of the three major teachings we turn our attention to The Emerald Tablet which may have been one of the earliest alchemical works that survives and was translated numerous times by many different authors from many cultures. Our focus is on a later translation of the text by Sir Issac Newton. In his translation, the second verse states, “That which is below is like that which is above, that which is above is like yet which is below”.

Newton’s Third Law of Motion

Needless to say, Newton played an important part in the Scientific Revolution, so much so that “Newtonian” came to be used to describe the bodies of knowledge that owed their existence to his theories. In 1669 Newton began work on what is considered one of the greatest scientific books ever written, Philophiae Natrualis Principia Mathematica which was finally published in 1687. The tile of the book was shortened to Principia, or Principles in English. The book contained Newton’s famous three laws of motion along with numerous other scientific theories. It is one of three laws of motion that were derived by Newton from Johann Kepler’s Laws of Planetary Motion and his studies of The Emerald Tablet that was the dawning of the Newton’s Third Law, which brings the history of median line analysis forward. The Third Law states that “for every action, there is an equal but opposite reaction”.

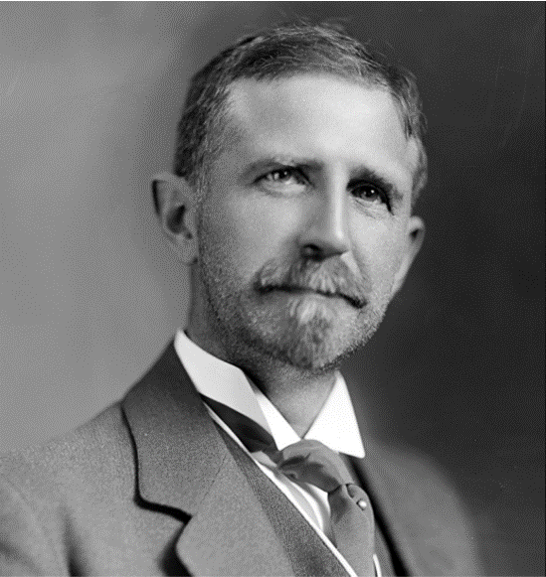

Roger Ward Babson (1875-1967)

Roger Babson was born in Gloucester, Massachusetts on July 6, 1875. His father was Nathaniel Babson, a dry-goods merchant in the city; and his mother was Nellie Sterns whose mother owned a millinery store. His was a typical childhood of that period, although he relates, he was an unruly child that suffered whippings by the hand of his teacher as did most children who “acted up” during school. The first statistics that Babson compiled even at that early age, were the record of thrashings that various boys and girls received during the school year. His score was forty-seven. This was a dubious start, but a start nonetheless to a renowned career as a statistician, bond trader, businessman, economist, and writer that spanned decades and left a legacy and place of notoriety in the history of financial markets. In his detailed book titled “Actions and Reactions An Autobiography of Roger W Babson” there are a numerous shared experiences of his youth, his college life and business career. We will not reiterate all of them, but we will share those that we feel had an impact on his later business years. It was his founding of Babson’s Statistical Organization and his long-standing relationship with a professor of engineering, George F. Swain, whom he studied under at the Massachusetts Institute of Technology where Babson received his training as an engineer from 1895-1898 and where the two men’s friendship was forged. It is their philosophical connection that interests us and their development of the normal or median line.

George Filmore Swain (1857-1931)

Babson was in New York selling his bond statistical analytical research on the day of the 1907 stock market crash and was taken aback by the large losses accumulated by supposed learned and experienced market professionals. At the time, he had been studying Benner’s Prophecies of Future Ups and Downs in Prices and How Money is Made In Security Investment, believing that there must be have been a way to forecast economic and market changes in a more proactive and less reactive manner. With these two books and his own amassed statistical data in hand he sought out his former professor and friend George Swain. Both concluded that there was the basis in these two books and Babson’s collected data that, when applied properly, could forge a new method of forecasting. It was Professor Swain who introduced and drew a “normal line” through the historical data in the Babson’s Composite Chart of pig iron, corn and, hogs that would normalize the volatile “zig-zagging” index Babson had been developing. (chart below). He also suggested that Newton’s Third Law of Action and Reaction may apply to this and other economic indicators, as it does to physics, chemistry, and astronomy. Thus, was the origin of the famous Babsoncharts that were integrated into Babson’s Statistical Organization’s publications and later analytically led to his famous timely prediction of the 1929 crash that was published in New York Magazine.

It was Babson’s further devotion to the work of Sir Issac Newton that later induced him to create of the Gravity Research Foundation at the suggestion of Thomas Edison. This suggestion was easily accepted as was revealed in a later essay he wrote called Gravity- Our Enemy Number One, he indicted his desire to overcome gravity stemming from the childhood drowning of his younger sister: (“She was unable to fight gravity, which came up and seized her like a dragon and bought her to the bottom”). It was at one of Babson’s seminars years later that he conducted that illustrated how Newton’s Third Law could be applied to the stock market when he met Alan Andrews. They became hardened friends and Babson taught Andrews his action and reaction techniques. Out of respect of Babson’s studies that he shared with Andrews, he later named his median line course the Action-Reaction Course in acknowledgement of his mentor’s teachings.

Dr. Alan Hall Andrews

Although Alan Andrew’s date of birth remains unknown, we do know he passed on in 1985. Little is known of his personal life, wife or children. His father owned a broker/dealer where he traded for clients and his own account and is said to have made a large amount of money in the Great Depression. Alan’s father sent him to engineering school at Massachusetts Institute of Technology and then on to Harvard. The story goes that after he graduated, his father challenged him to make one million dollars in one year while working at his father’s brokerage firm. He did not accomplish his father’s task in one year, but in two years had made one million dollars trading commodities. Andrews later became a lecturer in civil engineering at the University of Miami in Florida. After he retired, he returned to his roots and decided to not only manage his own investments but to teach others. He began publishing a weekly advisory newsletter that he sold by subscription that focused on his trading methods and included recommendations for the coming week. He also created the FFES (Foundation for Economic Stabilization) Case Study Course applying principles of mathematical probability to the production of profits from prognostication. It detailed various median line methods and other techniques that including fan lines which he referred to as Horn’s of Plenty. He sold the course for the tidy sum of $1,500 during the 1960’s and 1970’s. He also held seminars and one-on-ones that were attended by New York and Chicago pit traders. Andrews also often incorporated his student’s observations and studies into his work, careful to name methods such at Schiff Adjusted Median Line (named after Jerome Schiff a New York trader who brought it to his attention) and Hapogian Lines named after another one of his students Dr. Hapogian.

It has not been the authors’ intention to instruct readers in the History of the Development of Median Line Analysis on the construction of Median Lines or to delve into other rules or analytical idiosyncrasies of the different techniques or applications of Andrews Pitchfork. Those will be discussed in the blog posts that follow over the next few weeks.